oklahoma auto sales tax rate

Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. The Oklahoma sales tax rate is currently.

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325.

. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4264 on top of the state tax. How to Calculate Oklahoma Sales Tax on a New Car. New car sales tax OR used car sales tax.

There is also an annual registration fee of 26 to 96 depending on the age of the. The 2018 United States Supreme Court decision in South Dakota v. Excise tax is collected at the time of issuance of the new Oklahoma title.

The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. What is the sales tax in Oklahoma 2021. The County sales tax rate is.

Denotes Use Tax is due for sales in this city or county from out-of-state at the same rate as shown. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Oklahoma has recent rate changes Thu Jul 01 2021.

Tax and Tags Calculator. OK Sales Tax Calculator. Printable PDF Oklahoma Sales Tax Datasheet.

The value of a vehicle is its actual sales price. The state in which you live. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. Average Sales Tax With Local. Oklahoma residents are subject to excise tax on vehicles all terrain.

The Oklahoma Tax Commission estimated that government revenue decreased by 50 million from this change. In addition to taxes car purchases in Oklahoma may be subject to other fees like. There are a total of 356 local tax jurisdictions across the state collecting an average local tax of 3205.

609 rows 2022 List of Oklahoma Local Sales Tax Rates. The excise tax is also applied to all but the first 1500 of a used vehicles. Oklahoma has a lower state sales tax.

The excise tax is 3 ¼ percent of the value of a new vehicle. Registration fees are. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. The minimum combined 2022 sales tax rate for Yukon Oklahoma is.

The minimum combined 2022 sales tax rate for Woodward Oklahoma is. This means all new vehicle purchases are taxed at a flat combined rate of 45. Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax.

That must be added to the city tax and the State Tax. Excise tax is often included in the price of the product. August 2 2022 COPO LOCATION RATE CHANGE TAX TYPE TYPE OF CHANGE EFFECTIVE DATE.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Oklahoma Sales Tax Rates. 31 rows The state sales tax rate in Oklahoma is 4500.

On-Time Sales Tax Filing Guaranteed. The County sales tax rate is. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

The Yukon sales tax rate is. 2021 List of Oklahoma Local Sales Tax Rates. The most populous county.

Whether or not you have a trade-in. The Oklahoma sales tax rate is currently. Rates Effective April through June 2022 Updated.

The state sales tax rate in Oklahoma is 4500. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

The Woodward sales tax rate is. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types.

The base sales tax rate in Oklahoma is 45. There are special tax rates and conditions for used vehicles which we will cover later. The cost for the first 1500 dollars is a flat 20 dollar fee.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. There are a total of 470 local tax jurisdictions across the state.

Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4264 for a total of 8764. The county the vehicle is registered in. Did South Dakota v.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. With local taxes the total sales tax rate is between 4500 and 11500. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter.

This is also in addition to the State Tax Rate of 45. This is the total of state county and city sales tax rates. In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle purchases.

Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Wayfair Inc affect Oklahoma. Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted by law.

Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65. H ow 2021 Sales taxes are calculated for zip code 73170.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. This is the total of state county and city sales tax rates. The type of license plates requested.

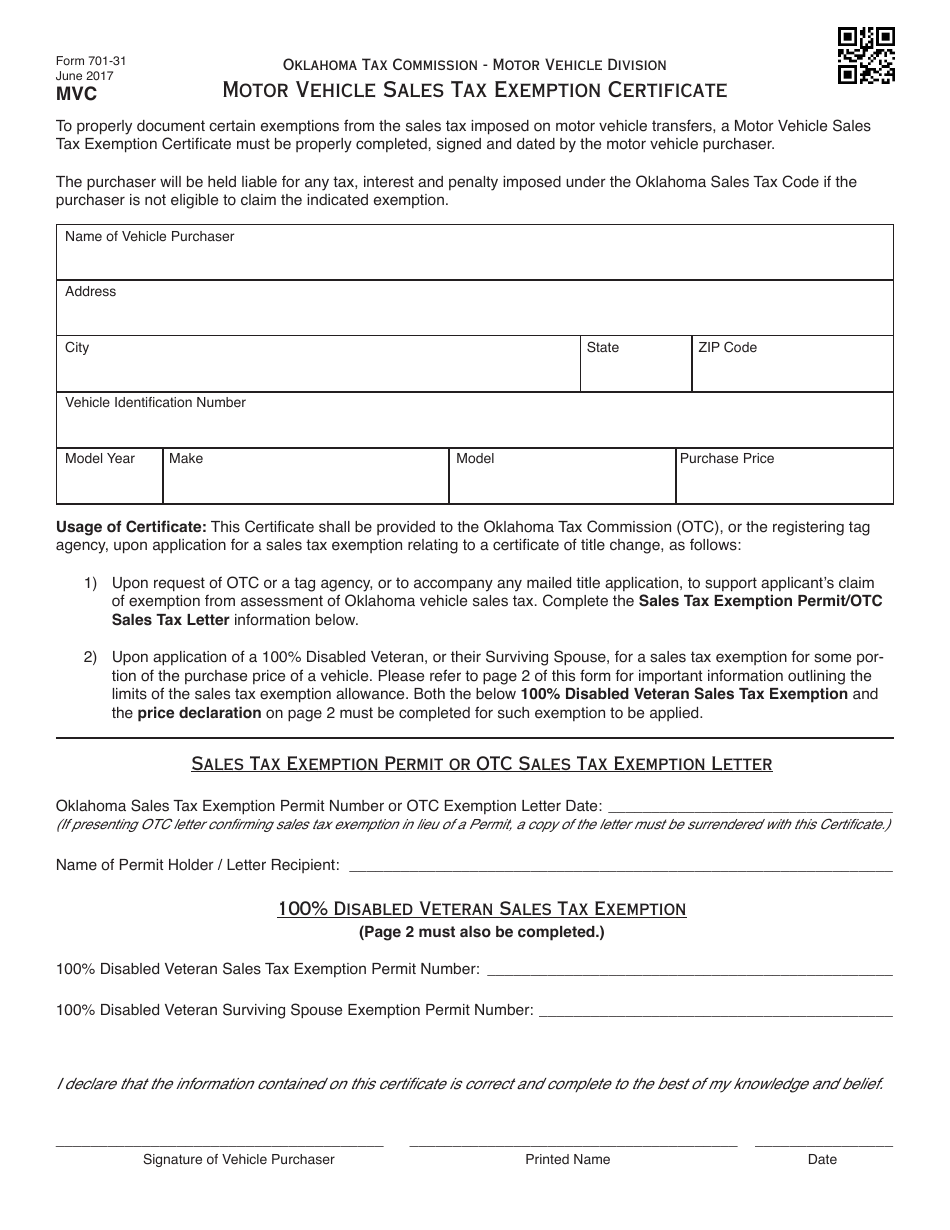

Otc Form 701 31 Download Fillable Pdf Or Fill Online Motor Vehicle Sales Tax Exemption Certificate Oklahoma Templateroller

Used Cars In North Carolina For Sale Enterprise Car Sales

Otc Form 701 31 Download Fillable Pdf Or Fill Online Motor Vehicle Sales Tax Exemption Certificate Oklahoma Templateroller

Tennessee Sales Tax Small Business Guide Truic

![]()

Oklahoma Gasoline And Fuel Taxes For 2022

Used Cars In Delaware For Sale Enterprise Car Sales

All Vehicles Enterprise Car Sales

All Vehicles Enterprise Car Sales

Used Cars In North Carolina For Sale Enterprise Car Sales

State Income Tax Rates Highest Lowest 2021 Changes

Illinois Sales Tax Guide For Businesses